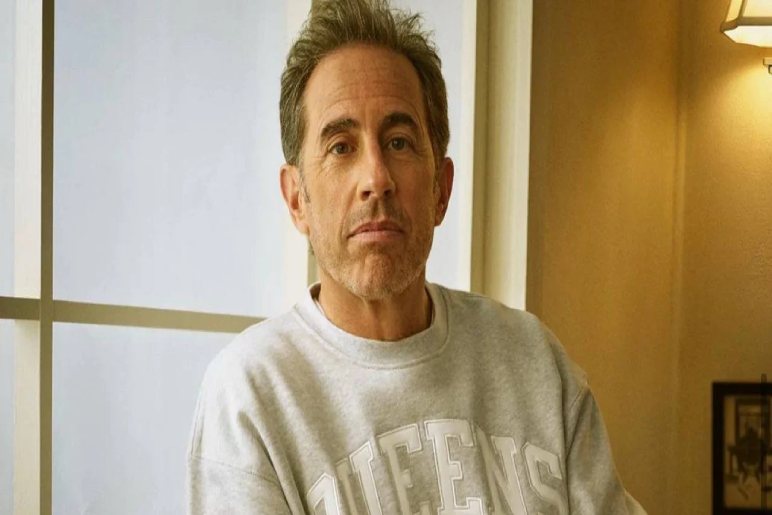

Jerry Seinfeld Net Worth, Lifestyle And Updates In 2024

Jerry Seinfeld, the comedic genius who is responsible for the profoundly successful satire “Seinfeld,” continues to enthrall audiences with his brilliant psyche and charming personality. Seinfeld’s impact stretches far past the domain of satire, and he may be the most successful comedian in the history of parody. Here, we will dig into Jerry Seinfeld net …

Jerry Seinfeld Net Worth, Lifestyle And Updates In 2024 Read More »